Inheritance has been described as a sort of a legal and fictitious continuation of the personality of a dead person. A ‘will’ is a testament that declares the intention of a person about their wealth and property, which they want to be executed after their death. If one were to die without a will, those wishes may not be carried out.

If a person dies intestate (without leaving a valid will), their wealth will be inherited by their heirs according to the inheritance laws of the land. Their heirs may be forced to spend additional time, money and emotional energy to settle their affairs after their loved one is gone.

Wills can vary in their effectiveness, but no one document is likely to resolve every issue that arises after one’s death. One can prepare a valid document but to be completely sure everything is in order, use an attorney or a professional to prepare it.

WHY WRITE A WILL

Through preparing a will, you can decide who gets what and in what proportion. You can keep your assets out of the hands of the people you don’t want to leave them to. One can identify who should care for your under-age children. Without a valid will in place, it is the courts that will decide. With a valid will in place, your heirs will have a less burdensome time getting access to your assets.

The requirements for what makes a will valid varies from country to country. In England and Wales, a Post-it note with your wishes written on it can be sufficient to count as a will

A will is, primarily, your direction on how your belongings like bank balances, property or prized possessions should be distributed among your family, relatives and friends. If you own a business in full or in partnership, or have investments in stocks, bonds, etc., your will can specify who will receive those assets and when. It also allows you direct assets to a charity. The will has a few omissions including pay-outs from the testator’s life-insurance policy as it has specified beneficiaries to receive the proceeds. The same is likely to apply to any investment accounts.

In addition to directing your assets, a will also documents your choice for a guardian for your minor children after your death. To prepare a will, one should have a list of assets and debts. Remember to include the contents of safe deposit boxes, family heirlooms, and other assets that you wish to transfer to a particular person, persons or entity. If you wish to leave specific personal property to specific heirs, begin a list of those allocations for eventual inclusion in your will.

USE PROFESSIONAL HELP

Strictly speaking, one does not necessarily need professional help to prepare a valid will, but it is highly advisable to take that help to avoid unnecessary complications after your death. According to a report, common mistakes could cause problems after your death and even cost your heirs their inheritance.

Among the things to consider: Unless you make a will following your marriage, the rules of intestacy apply. It is always a good idea to review your will at key stages in your life. Another thing to keep in mind is that the majority of married couples appoint their spouse as a trustee, an arrangement that will fail upon divorce.

If a person dies without leaving a valid will, their wealth will be distributed according to the laws of the land, forcing their heirs to spend additional time, money and emotional energy

The requirements for what makes a will valid varies from country to country. In England and Wales, a Post-it note with your wishes written on it can be sufficient to count as a will, provided it is executed correctly. The signature still has to be handwritten, however.

WILLS FOR NON-MUSLIMS IN UAE

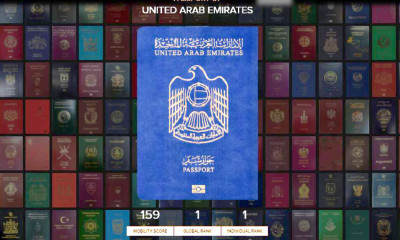

In the UAE, three-fourths of the population are expats from over 200 nationalities. Recent changes in the country’s residency policies mean that more foreigners are now spending their golden years in the UAE.

Expats over the age of 55 are eligible for a five-year renewable visa. The UAE launched a permanent residency scheme for expats in 2019. It has a 10-year residency scheme for investors, entrepreneurs, specialised talents, researchers and outstanding students, and their families.

There is no rule of survivorship in the UAE. In the event of the death of one of the accountholders, even a joint bank account will be frozen and funds unattainable until a court order is received

Most expats have a will in place in their country of origin before they move to live and work abroad. Non-Muslim expats in the UAE ought to be aware that, in the absence of a legally registered will in the UAE, the process of transferring assets after death can be time-consuming, costly and fraught with legal complexity.

WHO SHOULD WRITE A WILL

Any non-Muslim person who is over the age of 21, and has children below the age of 21 years or owns assets in Dubai – movable or immovable – should consider making a will. Many people think that because they do not own a house or any other form of real estate in Dubai, they do not need to write a will. That is a mistake.

There is no rule of survivorship in the UAE. In the event of the death of one of the accountholders, even a joint bank account will be frozen and funds unattainable until a court order is received. A valid will is one document that will help expedite the process and avoid complications.

Non-Muslim expats in the UAE ought to be aware that, in the absence of a registered will in the UAE, the process of transferring assets after death can be time-consuming, costly and fraught with legal complexity

If you have children and have not appointed a guardian for them under the terms of your will, then it would be at the discretion of the local UAE courts as to who would become your child’s guardian and how your assets – like cars and jewellery, for instance – would be distributed. In such circumstances, local Sharia laws would apply.

HOW TO GO ABOUT WRITING A WILL

For non-Muslims with assets in Dubai, there are two options for registering a will in Dubai: the Dubai Courts Public Notary or DIFC Wills Service Centre, which was previously known as DIFC Wills and Probate Registry. DIFC wills are completely in English while the Dubai Courts Will costs less and is bilingual (English and Arabic).

For non-Muslims, there are two options for registering a will in Dubai: the Dubai Courts Public Notary or the DIFC Wills Service Centre. DIFC wills are completely in English while the Dubai Courts Will costs less and is bilingual (English and Arabic)

Additionally, the DIFC Wills Service Centre only caters to non-Muslims in Dubai. The cost of a will in UAE differs based on where it is registered and whether it is a single or mirror will (two wills between a husband and wife). The approximate cost of preparing a will in Dubai is between Dh8,000 and Dh10m000 when registering at Dubai Courts. Meanwhile, the cost of a DIFC will ranges between Dh15,000 to Dh20,000. This cost of making a will with a lawyer includes drafting, translation and registration of a full will in Dubai.

The Dubai International Financial Centre launched a Wills and Probate Registry (now DIFC Wills Service Centre) for non-Muslim Dubai expatriates in late 2015. A wills registry for non-Muslims was also introduced in Abu Dhabi in 2017. For registering a will, Abu Dhabi is now on a par with Dubai and Ras Al Khaimah, where the DIFC Wills Service Centre protects the assets of non-Muslim expats by enforcing their wills after they pass away.

Local courts in Dubai allow non-Muslims to notarise a bilingual will before a Notary Public. Non-Muslim expatriates with assets in the UAE can make a will under the law of their home country to govern succession to his or her UAE estate instead of Sharia-based rules. Non-Muslim expatriates with assets in the UAE may register wills that create legal certainty for the inheritance of their assets after death and the appointment of guardians for their children.

ONLINE WILLS FOR NON-RESIDENTS

In 2017, Dubai introduced the world’s first-ever online will registration programme to take the hassle out of a time-consuming and onerous task for Dubai residents and investors. The DIFC Wills Service Centre, an ancillary body of the DIFC’s Dispute Resolution Authority, allows the creation and registration of wills by people through video conferencing. The will is digitally encrypted and stored.

The will registration system helped close a gap in the legal system. Previously, there was no clear mechanism for the registration of wills for non-Muslims and the only way to secure their assets was to request the application of the law of their home country, in keeping with the UAE’s personal status law.

A key advantage of the introduction of the virtual registry is that overseas customers can create and register their will through a video conferencing link. Overseas investors and non-residents are now able to protect their assets without attending an in-person registration appointment.

The DIFC Wills Service Centre released rules to allow non-Muslims to include all of their worldwide assets in a DIFC Will. The DIFC Wills Service Centre allows eligible non-Muslim individuals to formally register their English language Wills, enabling them to choose to dispose of their UAE or worldwide assets upon death as they see fit.

The will registration system helped close a gap in the legal system. Previously, there was no clear mechanism for the registration of wills for non-Muslims and the only way to secure their assets was to request the application of the law of their home country, in keeping with the UAE’s personal status law.

Otherwise, assets would be automatically distributed according to Sharia, which is based on a fixed share allocation system for the disbursement of assets. The new registry enables non-Muslims with assets in the country to have the option to bypass Sharia and instead allow their estates to apply the legal framework that they choose.

The new registry enables non-Muslims with assets in the UAE to have the option to bypass Sharia and instead allow their estates to apply the legal framework that they choose

It also offers flexible legal options, where previously there was inflexibility, to assist non-Muslim families in the event of the death of one of the parents. This better protects their intentions and eases the process that otherwise would be long, stressful and complicated. The growing number of non-Emirati property owners are also able to ensure their houses are passed on to their chosen relatives without dispute.